Unlocking Market Insights: A Comprehensive Guide to Forex Heat Maps

Related Articles: Unlocking Market Insights: A Comprehensive Guide to Forex Heat Maps

Introduction

With great pleasure, we will explore the intriguing topic related to Unlocking Market Insights: A Comprehensive Guide to Forex Heat Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Unlocking Market Insights: A Comprehensive Guide to Forex Heat Maps

- 2 Introduction

- 3 Unlocking Market Insights: A Comprehensive Guide to Forex Heat Maps

- 3.1 Understanding Forex Heat Maps

- 3.2 Benefits of Using Forex Heat Maps

- 3.3 Types of Forex Heat Maps

- 3.4 Utilizing Forex Heat Maps Effectively

- 3.5 Frequently Asked Questions about Forex Heat Maps

- 3.6 Tips for Using Forex Heat Maps

- 3.7 Conclusion

- 4 Closure

Unlocking Market Insights: A Comprehensive Guide to Forex Heat Maps

The forex market, characterized by its immense volume and constant fluctuations, presents both opportunities and challenges for traders. Navigating this complex landscape requires a keen understanding of market dynamics and the ability to identify emerging trends. Here, forex heat maps emerge as a powerful tool, offering a visual representation of market sentiment and activity, enabling traders to make informed decisions.

Understanding Forex Heat Maps

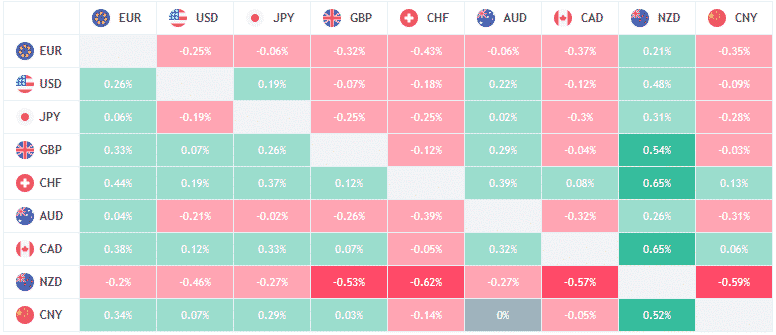

Forex heat maps are graphical representations that visually depict the strength or weakness of currency pairs, based on real-time market data. They typically display a matrix of currency pairs, with colors representing the relative strength or weakness of each currency. Red hues often indicate a strong currency, while blue hues denote a weak currency. The intensity of the color reflects the magnitude of the strength or weakness.

Key Components of a Forex Heat Map:

- Currency Pairs: Heat maps typically display a range of major, minor, and exotic currency pairs, allowing traders to assess the overall market sentiment.

- Color Gradient: The color scheme, usually ranging from red to blue, represents the strength or weakness of currencies.

- Data Sources: Heat maps draw information from various sources, including real-time price movements, trading volume, news sentiment, and economic indicators.

- Timeframes: Heat maps can be presented in various timeframes, from short-term (intraday) to long-term (weekly or monthly), enabling traders to analyze market trends at different scales.

Benefits of Using Forex Heat Maps

The use of forex heat maps offers several advantages for traders seeking to gain a comprehensive understanding of market dynamics and make informed trading decisions:

- Visual Clarity: Heat maps provide a clear and concise visual representation of market sentiment, making it easier to identify trends and patterns.

- Market Sentiment Analysis: By analyzing the color intensity and distribution, traders can discern the overall market sentiment towards specific currencies or pairs.

- Trend Identification: Heat maps help identify emerging trends, allowing traders to capitalize on potential price movements.

- Confirmation of Trading Ideas: Heat maps can confirm or refute trading ideas based on other technical and fundamental analysis methods.

- Time Efficiency: Heat maps offer a quick and efficient way to assess market conditions, saving traders time and effort compared to manually analyzing individual currency pairs.

Types of Forex Heat Maps

Forex heat maps are available in various formats, each offering unique insights and functionalities:

- Basic Heat Maps: These maps display a simple color gradient representing the strength or weakness of currency pairs, providing a basic overview of market sentiment.

- Correlation Heat Maps: These maps depict the correlation between different currency pairs, highlighting pairs that tend to move in tandem or in opposite directions.

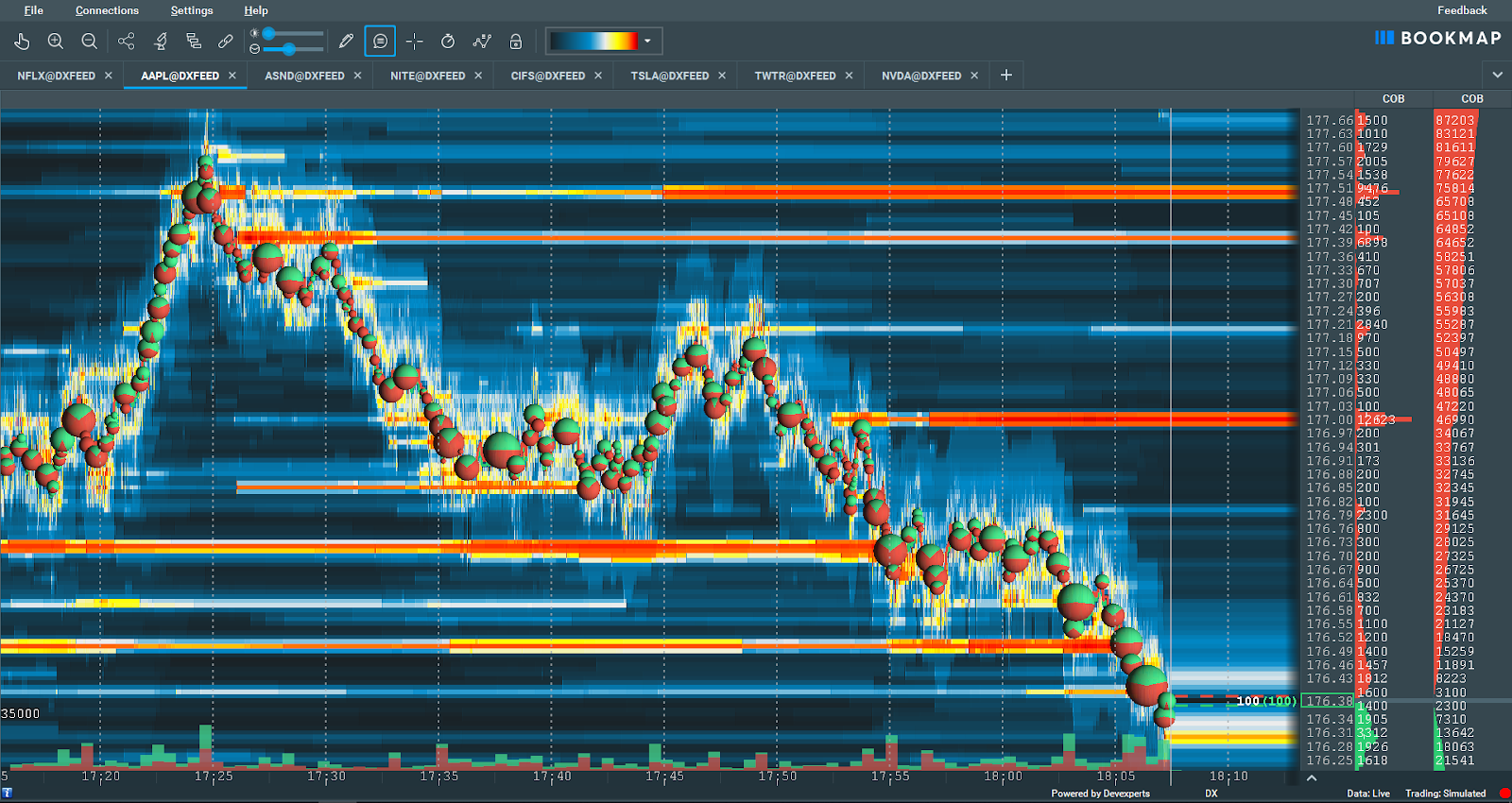

- Volume-Weighted Heat Maps: These maps incorporate trading volume into the analysis, providing a more nuanced representation of market sentiment by considering the magnitude of trades.

- News-Driven Heat Maps: These maps integrate news sentiment analysis, reflecting the impact of recent news events on currency valuations.

Utilizing Forex Heat Maps Effectively

To maximize the benefits of using forex heat maps, traders should follow these strategies:

- Choose a Reputable Source: Select a reliable provider that offers accurate and up-to-date market data.

- Consider Timeframes: Analyze heat maps at different timeframes to identify short-term and long-term trends.

- Combine with Other Analysis: Utilize heat maps in conjunction with other technical and fundamental analysis tools for a comprehensive market assessment.

- Focus on Key Currency Pairs: Prioritize analyzing the most traded and influential currency pairs to gain a deeper understanding of market dynamics.

- Monitor Economic Events: Stay informed about upcoming economic events that could impact currency valuations and influence heat map readings.

Frequently Asked Questions about Forex Heat Maps

Q: Are forex heat maps a reliable indicator of future price movements?

A: Forex heat maps can provide valuable insights into market sentiment and emerging trends, but they are not a guaranteed predictor of future price movements. Market conditions are constantly evolving, and other factors can influence price fluctuations.

Q: Can forex heat maps be used for scalping or day trading?

A: While heat maps can offer insights into short-term market fluctuations, they are not ideal for scalping or day trading due to the rapid and unpredictable nature of these strategies.

Q: How can I find a reliable forex heat map provider?

A: Look for providers with a proven track record, transparent data sources, and user-friendly interfaces. Consider reading reviews and comparing different platforms before making a decision.

Q: Are there any limitations to using forex heat maps?

A: Forex heat maps are based on real-time data, but they can be influenced by market manipulation or sudden news events. It’s essential to use heat maps in conjunction with other analysis tools and exercise caution when interpreting the information.

Tips for Using Forex Heat Maps

- Focus on Major Currency Pairs: Pay attention to the most traded currency pairs as they often drive market sentiment.

- Look for Divergences: Monitor for discrepancies between heat map readings and actual price movements, as these could indicate potential trading opportunities.

- Consider Economic Calendars: Stay informed about upcoming economic releases that could impact currency valuations.

- Use Heat Maps as a Confirmation Tool: Utilize heat maps to confirm trading ideas based on other technical and fundamental analysis methods.

Conclusion

Forex heat maps offer a valuable tool for traders seeking to gain a comprehensive understanding of market sentiment and identify emerging trends. By providing a visual representation of currency strength and weakness, heat maps enable traders to make informed decisions and potentially capitalize on market opportunities. However, it’s crucial to remember that heat maps are just one piece of the puzzle and should be used in conjunction with other analysis tools and a thorough understanding of market dynamics. By leveraging the insights provided by forex heat maps, traders can navigate the complex world of forex trading with greater confidence and potentially achieve better results.

Closure

Thus, we hope this article has provided valuable insights into Unlocking Market Insights: A Comprehensive Guide to Forex Heat Maps. We thank you for taking the time to read this article. See you in our next article!